Chaos is profit in disguise

Opportunistic multi-strategy investment fund

Dellwood Capital was founded in 2009 as a dedicated public markets equity fund, focused on disruptive technology and high growth opportunities.

Dellwood Capital, founded in 2009, is a dedicated TMT long-bias public markets equity fund with a strong focus on disruptive technology and high-growth opportunities. Our mission is to consistently generate alpha, driving superior returns for our investors. Since 2018, we have achieved an impressive Internal Rate of Return (IRR) of over 18%, underscoring our commitment to identifying and capitalizing on market trends that offer significant growth potential. Through our strategic investments, we continue to position ourselves at the forefront of financial innovation.

About Us

Philosophy: Turning Chaos into Opportunity

At Dellwood Capital, we believe that chaos is profit in disguise. As an opportunistic, multi-strategy investment fund, we thrive on market inefficiencies, leveraging our deep expertise to turn volatility into sustained growth. Since our founding in 2009, we have been at the forefront of identifying and capitalizing on disruptive technology and high-growth opportunities, consistently generating alpha for our investors. Our investment philosophy blends opportunism with discipline, ensuring that we maximize returns while maintaining a strong risk management framework. read more

At Dellwood Capital, we believe that chaos is profit in disguise. As an opportunistic, multi-strategy investment fund, we thrive on market inefficiencies, leveraging our deep expertise to turn volatility into sustained growth. Since our founding in 2009, we have been at the forefront of identifying and capitalizing on disruptive technology and high-growth opportunities, consistently generating alpha for our investors. Our investment philosophy blends opportunism with discipline, ensuring that we maximize returns while maintaining a strong risk management framework. read more

Diversified Strategy Across Asset Classes

With over 50 years of collective investment experience, Dellwood Capital employs a proven multi-asset playbook that spans public equities, private debt, and niche alternative opportunities. Our portfolio is strategically balanced, with 60% allocated to public markets—focused on dominant technology household names such as Google, Microsoft, Amazon, and Tesla—and 40% in private credit, where we uncover high-yield, undervalued investments. read more

With over 50 years of collective investment experience, Dellwood Capital employs a proven multi-asset playbook that spans public equities, private debt, and niche alternative opportunities. Our portfolio is strategically balanced, with 60% allocated to public markets—focused on dominant technology household names such as Google, Microsoft, Amazon, and Tesla—and 40% in private credit, where we uncover high-yield, undervalued investments. Our ability to adapt to shifting market dynamics has enabled us to maintain an impressive track record, delivering an Internal Rate of Return (IRR) exceeding 18% since 2018. read more

Consistency Across Market Cycles

Our ability to adapt to shifting market dynamics has enabled us to maintain an impressive track record, delivering an Internal Rate of Return (IRR) exceeding 18% since 2018. This performance is a testament to our disciplined investment process and our ability to find value across market conditions. read more

Our approach is defined by a keen ability to navigate high-volatility environments. We embrace technical, macro, and fundamental analysis to guide our investment decisions, employing a thoughtful shorting strategy, options trading, and technical criteria-driven positions. Profit-taking remains a core pillar of our strategy—we believe in consistently locking in gains rather than chasing home runs. read more

Tactical Execution and Risk Management

Our approach is defined by a keen ability to navigate high-volatility environments. We embrace technical, macro, and fundamental analysis to guide our investment decisions, employing a thoughtful shorting strategy, options trading, and technical criteria-driven positions. Profit-taking remains a core pillar of our strategy—we believe in consistently locking in gains rather than chasing home runs. read more

Founded by Serge and Peter Milman, Dellwood Capital initially launched as a long-short TMT fund, generating over 45% returns in its first year. Over the years, our firm has evolved into a dynamic, multi-strategy fund, integrating private credit in 2017 to further diversify our portfolio and drive consistent outperformance. Supported by a team of seasoned professionals, including Ben Reiter (Head of Venture/Private Equity) and Gabriel Arant (Head of Investor Relations), we are committed to delivering superior value through innovation, agility, and disciplined execution. read more

Origins and Evolution

Founded by Serge and Peter Milman, Dellwood Capital initially launched as a long-short TMT fund, generating over 45% returns in its first year. Over the years, our firm has evolved into a dynamic, multi-strategy fund, integrating private credit in 2017 to further diversify our portfolio and drive consistent outperformance. Supported by a team of seasoned professionals, including Ben Reiter (Head of Venture/Private Equity) and Gabriel Arant (Head of Investor Relations), we are committed to delivering superior value through innovation, agility, and disciplined execution. read more

At Dellwood, we don’t just react to uncertainty—we capitalize on it. By combining strategic insight with a relentless pursuit of opportunity, we continue to redefine what’s possible in investing. read more

Vision: Capitalizing on Uncertainty

At Dellwood, we don’t just react to uncertainty—we capitalize on it. By combining strategic insight with a relentless pursuit of opportunity, we continue to redefine what’s possible in investing.

In the midst of uncertainty lies untapped potential for profit. Our agile, multi-strategy investment fund thrives on the opportunities that unpredictable markets present, viewing volatility not as a risk but as a gateway to growth. With a keen eye on shifting market dynamics, we adapt quickly, deploying diverse strategies that allow us to capitalize on emerging trends and unexpected changes. By embracing the possibilities within chaotic conditions, we aim to transform volatility into sustained growth, delivering exceptional value through innovation and strategic insight.

Serge Milman

Chief Investment Officer, Co-Founder

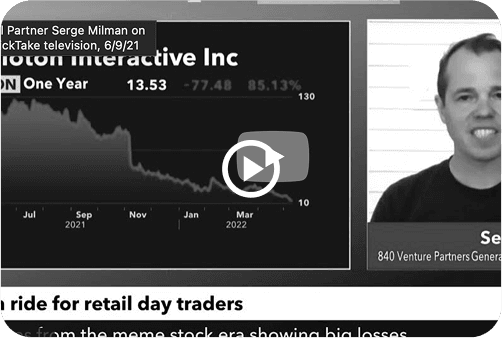

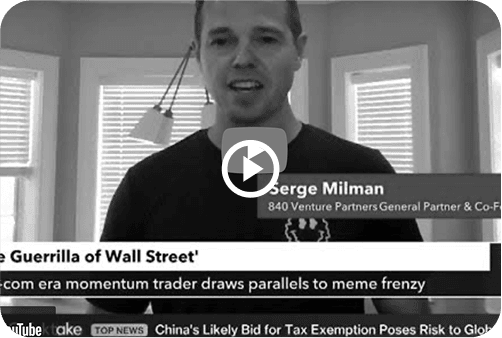

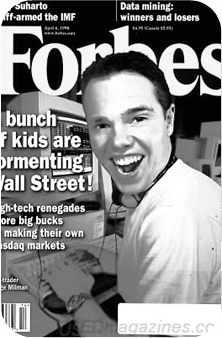

Serge Milman is a veteran Wall Street trader and hedge fund manager. Serge got his start trading equities in 1998. At the age of 24, Serge was featured on the cover of Forbes and was the youngest person featured on the cover until Mark Zuckerberg came along.

Serge went on to launch Ronin Asset Management in 2001. At its peak Ronin had over 70 traders and portfolio managers employed.

In 2009, Serge finally raised outside capital and launched what would become Dellwood Capital Partners with his brother Peter Milman. The fund’s initial philosophy was long/short TMT. Given that the fund was founded in the midst of the financial crisis, this was a salient strategy at the time. In 2015, Dellwood pivoted to a more long biased model and began making outside investments in private debt.

Serge is a graduate of the NYU Stern School of Business, BA.

read more

Ben Reiter

Head of Private Equity / Investor Relations

Benjamin Reiter is an experienced venture capital investor with a multi-disciplinary background. Prior to founding 840 Venture Partners, Benjamin held a lead operational role as Principal at Starta Ventures, an early-stage venture capital firm, and startup accelerator in New York City. His responsibilities consisted of diligencing technology companies across a range of verticals, negotiating and closing investment deals, co-directing the firm's flagship startup accelerator program, and managing the firm's portfolio of over 100 companies. Benjamin worked closely with over 70 startup companies from around the world in Starta Accelerator, supporting them in all aspects of strategic growth. He has successfully negotiated and closed over 50 venture investment deals, and has screened over 1,000 investment prospects, from pre-seed to round A stages. read more

In addition to his work at 840VP, Benjamin currently serves as an Advisory Director at people analytics startup Cognitive Talent Solutions USA, and is an active mentor at several startup accelerator programs.

Benjamin spent the first part of his career as an accounting analyst at In Demand Networks, earning responsibility for the analysis of over $100 million in annual receivables. He has an MBA with a concentration in Human Resource Management from the Zicklin School of Business at Baruch College, and an MS in Nutritional Sciences from San Diego State University. read more

Peter Milman

Co-founder / Asset Manager

Peter is the Co-Founder and Asset Manager at Dellwood Capital LP. Peter's allocations range from long/short niche trading strategies, private debt financing, Digital asset/crypto, and direct trading. Peter's approach has been fine-tuned with over 24 years of investing experience. Deep-rooted channels have provided early access into new investment opportunities that Peter has cultivated over the years. read more

His trading career started at Broadway Trading where he developed repeatable trading models that relied on fundamentally strong companies but utilized a systematic approach to timing. Technical analysis gave Peter confidence in defining entry and exit points. To this day, Peter focuses his time on disruptive leaders in tech. In 2015, Peter was an early investor in the cryptocurrency world. While the adoption of crypto and blockchain tech continues to develop, Peter leads the team with his pursuit of returns and alpha generation in the crypto space.

Peter graduated from Stern School of Business, NYU with a Finance and Math degree in 1998. In 2008 Peter was featured in a 6-page article in New York Magazine that portrayed a day in the life of a trader. read more

Our Strategy

With a focus on technology household names, opportunistic trading, and macro opportunities, we employ a comprehensive strategy to maximize returns while carefully managing risk.

At Dellwood, we have a long bias and invest in tech household names that dominate their respective markets. Companies like Google, Microsoft, Apple, Amazon, Tesla, Netflix, Shopify, Nvidia, and more are core holdings in our portfolio. We allocate a significant portion of our assets under management (AUM), with typical investments reaching as high as 10%. By targeting market leaders with near-monopolistic control, we aim to capture long-term value and growth potential.

In the shorter term, Dellwood’s roots focus on quicker, opportunistic investments. These include “meme” stocks like Gamestop as well as other unique opportunities like oil, lumber, and other stocks where volatility is spiking.

Dellwood seldom naked shorts equities. Instead, we focus on options and derivatives where risk is controlled while upside can be unlimited.

Profit taking is a core mantra at Dellwood. The founders very much believe in the thesis that you can never go broke taking profits. Dellwood very much utilizes the Derek Jeter mentality of always getting on base hitting singles and doubles instead of swinging for the fences.

Frequently Asked Questions

Dellwood Capital, established in 2009, is a specialized public markets equity fund dedicated to disruptive technology and high-growth investment opportunities. Founded by Serge and Peter Milman, Dellwood has positioned itself as a leader in the financial sector, focusing on innovative strategies to drive growth in volatile markets. The firm's approach combines deep market expertise with a commitment to high-potential, forward-thinking investments.

Since 2018, Dellwood Capital has consistently delivered an impressive Internal Rate of Return (IRR) exceeding 18%, underlining its effective strategy of identifying and investing in market trends with significant growth potential. This achievement reflects Dellwood's commitment to not only generating alpha but also prioritizing long-term value for its investors, making it a reliable option for those looking to maximize their investments in a rapidly changing market landscape.

Dellwood Capital takes a balanced approach to risk management, leveraging the inherent diversification of cross-asset investing to mitigate risk while optimizing returns. By investing in both public equities and private debt, Dellwood maintains a portfolio resilient to market fluctuations. Additionally, the firm proactively adjusts its strategies to stay aligned with market trends, aiming to balance risk and reward to achieve sustainable growth.

Dellwood Capital was co-founded by Serge Milman, who serves as Chief Investment Officer, and Peter Milman, who leads asset management. Serge initially established Dellwood as a long-short TMT fund and integrated private credit into the portfolio, significantly boosting returns. The team also includes Ben Reiter, Head of Venture and Private Equity, and Gabriel Arant, Head of Investor Relations, both bringing a wealth of experience and strategic insights that have driven Dellwood’s success in venture capital and investor engagement.

Dellwood Capital employs a multi-strategy approach that combines public equities, private debt, and targeted investments in disruptive technology. This strategy enables Dellwood to take advantage of high-growth opportunities while managing risk. By focusing on both traditional and emerging markets, the firm maintains a disciplined yet opportunistic approach, allowing for proactive investment adjustments that maximize returns for investors across diverse asset classes.

Dellwood Capital focuses its investments on technology household names like Google, Microsoft, Apple, and Tesla, as well as other companies with near-monopolistic control in their sectors. These market leaders form the core of Dellwood’s portfolio, representing stable, long-term investments that drive sustained growth. Dellwood also seeks out emerging technologies, private debt, and macro opportunities, expanding its reach to capture value across high-potential sectors and newer financial instruments.

Dellwood Capital's approach to high-growth opportunities is rooted in diligent research and a diversified portfolio. By combining public equity investments with private debt and alternative assets, Dellwood ensures a balanced risk profile while actively pursuing opportunities in the tech industry and other disruptive sectors. This approach enables the firm to capitalize on high-growth investments while minimizing exposure to market volatility, positioning Dellwood as a forward-thinking, resilient player in the financial landscape.

Dellwood Capital has demonstrated a strong track record of consistently delivering superior returns regardless of market conditions. This success is attributed to Dellwood's investment philosophy of thorough research, meticulous analysis, and strategic discipline. Through its diversified investment portfolio and multi-asset playbook, Dellwood has successfully navigated various economic cycles, ensuring that investors experience stable and predictable growth over time.

Dellwood Capital thrives in uncertain and volatile markets, viewing these conditions not as risks but as gateways to growth. By deploying an agile, multi-strategy investment model, Dellwood is able to capitalize on emerging trends and sudden market shifts. This adaptability is a core part of Dellwood’s strategy, enabling the firm to quickly adjust its portfolio as market dynamics evolve, thus creating a unique advantage for investors looking for both security and growth in changing economic climates.

Investor relations is a key component of Dellwood Capital's commitment to client satisfaction and value creation. Led by Gabriel Arant, Dellwood's Investor Relations team leverages years of experience in both startup acceleration and investment management to enhance communication and engagement with investors. By providing clients with transparent insights and personalized support, Dellwood ensures that investor expectations are not only met but exceeded, fostering a strong and trusted relationship with its clients.